Trend and Technology Outlook

Wide Format & Signage and Textiles & Apparel

In our annual Technology Outlook, we tend to group wide-format and signage, and textiles and apparel together, as there is a bit of overlap—maybe not in terms of end users, but certainly in terms of equipment and manufacturers. Soft signage is perhaps the best example of where the two segments overlap, but companies like Mimaki, EFI, Durst and others are active in both wide-format and textiles.

Wide-Format & Signage

If there is one recent news story that, in a way, sums up the current state of wide-format printing, it was the acquisition of Inca Digital by Agfa.

Inca Digital is a pioneer: the Eagle 44, launched in January 2001, expanded the types of substrates that a wide-format flatbed could print on, jumpstarting what would become some of the hottest display graphics applications.

Still, why the acquisition is symbolic is that Inca—and SCREEN GP IJC, which was also part of Agfa’s acquisition—was developing single-pass machines for corrugated printing. Packaging. So, in some sense, we are starting to see packaging step on wide-format’s toes a bit, as the focus is less on display graphics and more on packaging applications—and there is no doubt that packaging is the higher-growth segment at the moment. This is not to say that wide format is moribund; quite the opposite. But what we have been seeing over the past five or six years is a maturing of the wide-format market.

The commercial print businesses that have expanded into wide format have already done so, and the majority of the rest have no interest in it—our recent Printing Outlook surveys have found that about 30% of commercial printers are “never wides,” or as was overheard at 2019’s PRINTING United show, “What’s all this wide format stuff doing here?”

In many ways, packaging today is where wide-format was in the early 2010s—the exciting new area to get into, with revolutionary new equipment appearing regularly and revolutionary new applications being enabled by all the new tech. Again, this is not to say that wide-format printing today is not exciting, it’s that the changes now are more evolutionary than revolutionary.

Today’s Trends

I’m not going to say too much about the unholy trinity of challenges that have plagued the industry this year—employment, supplies shortages and inflation. Let’s just take them as given and move on. There are more interesting things to look at.

Supreme Courtship

First of all, there was a major signage case pending before the U.S. Supreme Court, which was decided on April 21. The case, Austin v. Reagan, had the potential to completely upend the signage industry if the Court tossed out the traditional regulatory distinction between on-premises signs and billboards as being location-based, not content-based. Happily, the nightmare scenario was averted, as the Court decided to maintain that regulatory distinction. Whew!

Constructive Criticism

One indicator that’s useful to track is the American Institute of Architects (AIA) monthly Architecture Billings Index (ABI), which tracks the demand for architectural design services (i.e., billings). This index includes commercial and industrial buildings like hotels and offices, schools, hospitals, multi-family residences and other such facilities.

In April, the AIA found that in March the ABI soared from 51.3 to 58.0. Any ABI score over 50 indicates an increase in billings by architectural design firms. The rule of thumb is that this index leads actual commercial real estate investment by about 9–12 months, so, barring any further supply chain disruptions or massive COVID surges, there looks to be a pick-up in commercial and industrial real estate development as we head through 2022. Sign businesses should keep an eye on construction activity in their area to get a jump on involvement in these projects.

Demo Centers

I have pointed out in past articles that demographic changes can impact the wide-format and signage business, positively as well as negatively. For example, the Great Resignation/Reshuffling/Whatevering has made finding employees a challenge, but as it is largely fueled by an entrepreneurial drive, has caused a massive rise in new business formation, businesses which need signage and other kinds of graphics. We also noted in last issue’s "Franchise Review" that it has also resulted in a rise in new franchise owners and thus an expansion of the print and sign franchise networks.

One other set of demographic changes caught my eye recently.

The Census Bureau released its National Population Statistics: 2020–2021, which includes the top age cohorts for 2020 and 2021, as well as their projections for 2030.

In a nutshell—via Calculated Risk—last year, six of the top seven age cohorts were under 40, and by 2030 the top 10 cohorts will be the youngest 10 cohorts. After the 2010 Census, the younger Boomers dominated the population distribution, but as of the 2020 Census, it’s the millennials and Gen Z (or whatever we’re calling them).

Why is this important? It means not only that the prime working age population is increasing, but there will be increased demand for things like housing, durable goods, cars and all the other stuff that younger people—and people who are starting families—buy. In a nutshell, a “youthening” of the population bodes well for the economy.

Empty Nesting

For the longest time, “automation” in wide format meant little more than nesting optimization, and for good reason.

According to Keypoint Intelligence, 88% of wide-format providers gang and nest jobs manually—with 59% of respondents saying that manual nesting takes, on average, 1–10 minutes per job, and another 19% saying it takes even longer. They cite in particular Tilia Labs’ AI-based approach to nesting optimization which “uses experientially learned pattern recognition to identify efficient potential nesting approaches across images and jobs. Thus, the solution combines the power of computers to inspect millions of combinations while also borrowing the human ability of starting with the most likely candidates.”

Other wide-format automation options are emerging, which can be software- or hardware-related.

On the software side, a good start is a web-to-print portal that allows customers to get quotes, submit jobs, or purchase standardized templated products.

Historically, the bandwidth required for submitting wide-format jobs was a bit of a limitation, but in today’s cloud-powered world, it’s much less of one. A lot of sign and display graphics providers built out web-to-print portals during the pandemic. Once jobs are in the system, they can be optimized for cutting and then routed to the appropriate output device.

On the hardware side, automated feeding systems and even robotics to load and offload boards much more quickly and accurately—and more safely—than human hands can manage.

“3D” Printing

As I note elsewhere in this issue, 3D printing in the world of wide format doesn’t necessarily mean what we think it means—that is, additive manufacturing used to build up three-dimensional objects.

While units from Mimaki (in the entry-level/mid-production range) and Massivit (high end) have their niches, at the moment they are not entirely practical or economical for everyday display and signage graphics.

What is serving the purpose of 3D printing is using a UV flatbed machine—units from DCS and Mutoh are especially favored—to build up layers of ink for Braille lettering for ADA-compliant signage. This isn’t especially new—flatbeds have long had the ability to layer ink not just for ADA lettering but also to add texture and other dimensional effects—but more machines are letting signage producers take full advantage of this capability.

Sustainability

As in virtually every other part of the industry (or economy), there is an interest in sustainable business practices. In wide format (and especially textiles), there are a variety of components that comprise sustainability, although some are becoming less important while others are becoming more so. The most obvious contributor to a print business’s overall sustainability is the materials used. While those are still important, things that are becoming more important are end-of-life issues. That is, what do end users do with display graphics or textiles when their active life is over? And how do print businesses ensure that their operations in general are run sustainably?

These are some quick hits on some of the wide-format trends to pay attention to.

New Products

Some caveats on new product announcements. In order to keep the list below at a manageable length for a print publication, I have focused on wide-format-related product releases and/or announcements that have been made since the end of 2021. As we get closer to the first in-person PRINTING United show since 2019, we are likely to see more new releases and announcements in the latter half of the year.

Printing Equipment

Launched at January’s EFI Connect, the 126-in. EFI Pro 30h UV LED printer prints up to 2,477 ft.2/hr. and is a hybrid flatbed/roll-to-roll superwide-format targeted to businesses that see high-volume production of display graphics as a growth opportunity.

I’m going to contradict myself near the outset and highlight a unit that was launched last year.

LogoJet, initially founded to print on golf balls, has expanded its tchotchke-printing capabilities over the years, and last year won a PRINTING United Pinnacle Product Award for its FSR90 Edible Ink printer, which offers full-color personalization with food-grade inks on edible items. It features a 24 x 36-in. printable area and 6-in. product height. Such units are often beta-tested; perhaps this is also beta-tasted.

CAPTION: Printing on food with the LogoJet FSR90 Edible Ink printer.

Mimaki had a busy year so far. In March, they launched the new CG-AR Series of cutters/plotters specifically geared for entry-level users. This series comprises two units: the CG-60AR, with a 606mm-wide cuttable area) and the CG-130AR (1,370mm-wide cuttable area).

CAPTION: Mimaki CG-AR cutter/plotter.

Mimaki also introduced the TS330-1600 sublimation transfer inkjet printer, the flagship model of its new 330 Series. This unit introduces “Mimaki Weaving Dot Technology (MWDT),” which changes the order of ink droplet placement depending on printing conditions in order to reduce or eliminate streaks or uneven printing caused by slight individual differences in the printhead or subtle deviations in adjustment. The new unit is also said to be 138% faster than earlier models.

Mimaki’s new “330 Series” roll-to-roll solvent printers comprises the JV330-130/-160 and CJV330-130/-160, and these units also feature the aforementioned MWDT. The JV330-130/-160 and CJV330-130/-160 print up to 21.0m2/hr. in standard mode with four colors (CMYK), and 13.2m2/hr. with eight colors (CMYKLc LmLkOr).

Mutoh has also been hard at work this year. Launched in January, the new 54-in. XpertJet 1341SR Pro solvent printer replaces the ValueJet 1324X and features Mutoh’s new AccuFine printheads. The 1341SR Pro is up to 42% faster than its predecessor.

Launched in February, the 64-in. ValueJet 1628MH is a hybrid flatbed/roll-to-roll printer that can print up to eight colors, including CMYKx2 and CMYKWhWh (yes, that is white ink). Mutoh’s new VerteLith RIP software is bundled with FlexiDESIGNER MUTOH Edition 21, which is ideal for signage and banners.

CAPTION: Mutoh ValueJet 1628MH

Dye-sub is where it’s at, and late last year Mutoh launched the XpertJet 1642WR Pro dye-sublimation printer, a mid-level unit targeted for home décor, soft signage, sports apparel and fashion applications.

Late last year, Ricoh launched two new units, one in its UV flatbed line and the other in its roll-to-roll latex line. The RICOH Pro TF6251 UV LED flatbed can print on items up to 4.3-in. thick and comes with two ink configurations, depending on desired application. It also adds a new rollfed option. The 64-in. RICOH Pro L5160e latex roll-fed printer can be configured to print CMYK, CMYK+White (yep, white), or CMYK + Orange & Green.

Roland launched its third-generation TrueVis Series inkjets. The VG3 Series comprises the 64-inch VG3-640 and the 54-inch VG3-540 and offers six ink configurations, including a new 8-color (CMYK+Lc+Lm+Or+Gr) option. The SG3 Series comprises the 54-inch SG3-540 and 30-inch SG3-300, which are more entry-level versions of the corresponding VG3 printers.

CAPTION: Roland TrueViz VG3 and SG3 Series.

SwissQprint launched its Flatbed Generation 4, which features a new improved printhead to improve the already impressive quality of the Impala and Nyala models, as well as boost speed. The entry-level Oryx model is nearly 40% faster than its predecessor.

Software

As I said earlier, automation in wide format is often synonymous with nesting optimization, and to that end, EFI launched its Fiery Prep-It true-shape nesting and cut-preparation software. It connects to any digital front end (DFE) and includes full integration with EFI Fiery proServer and Fiery XF DFEs. If you still manually nest jobs, this solution can reduce nesting time by up to 90%.

At the ISA Sign Expo, Onyx Graphics offered a glimpse of the next major release of ONYX software that offers print service providers a new drag-and-drop user experience and easy-to-use tools for everyday automation. The next release will be available for all ONYX’s solutions, including ONYX Thrive and ONYX RIP products. This latest release builds on ONYX 21.1 that introduced Swatch Books 2.0 for faster color matching and PDF tile maps to streamline tile-job installation. More to come.

Onyx also announced a new annual prepaid option for ONYX Go, the company’s subscription RIP software. In addition to the no-contract monthly subscription, Onyx offers one-, three- and five-year prepaid options available through Authorized ONYX Resellers. ONYX Go prepaid is available for both ONYX Go Lite and ONYX Go Plus product tiers.

SAi FlexiDESIGN is the leading design software for the sign and print industry but has hitherto only been available for PCs. Earlier this year, the company finally made it available to Mac users.

Finishing

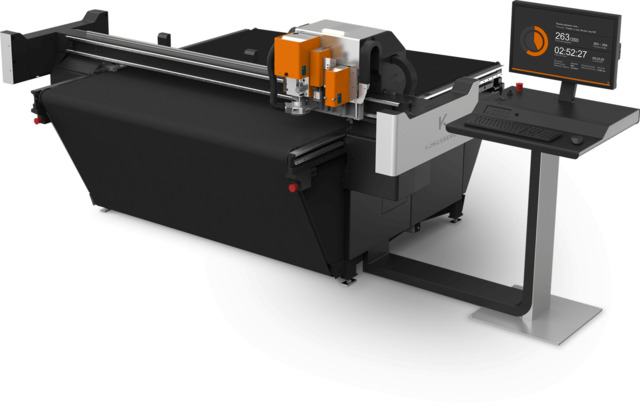

On April 6, Kongsberg celebrated its one-year anniversary as a standalone company (you may recall it had previously been part of Esko). Shortly after going solo, the company launched the Kongsberg C20, the smallest (1.6m x 1.4m) high-speed production cutting table on the market. Last August, Kongsberg acquired MultiCam, Inc., a manufacturer and distributor of Computer Numerical Control (CNC) cutting machines and digital finishing processes, expanding its footprint across North America and Europe as a provider of digital finishing and CNC routing machines.

CAPTION: Kongsberg C20.

Another big name in big cutting tables is Zünd, which late last year introduced Zünd Connect, a software solution that compiles production data from Zünd cutting systems into meaningful key performance indicators, such as cutter capacity, availability and overall equipment effectiveness, the goal being to identify areas in the digital cutting workflow with the potential for optimization.

Substrates

New substrates and materials are proliferating like mad, and we could easily fill this entire issue with new materials hitting the market. The substrates cited below are a few representative examples of what has become available in the last six months or so.

Avery Dennison introduced an all-new Dusted Crystal decorative, frosted, architectural window film. Available in matte and luster finish, the film offers privacy while providing a translucent light effect for interior environments.

Drytac has made its popular Polar Choice White monomeric PVC films available globally. Originally limited to the UK and EU, the films are compatible with latex, UV and eco-solvent inks, and are suitable for flat signage and general advertising applications, including windows, POP displays, stickers and decals.

Fisher Textiles, usually known for its fabrics for digital printing, has added artificial turf to its portfolio of materials. Available in three weights and pile heights, applications include event and retail space flooring, backdrop walls and recreational zones for putting greens, cornhole games, children and pet play areas and more.

CAPTION: Fisher Textiles’ Artificial Turf.

FloorSignage launched DriveOn Graphics, wide-format print media designed to be applied to surfaces that support both vehicle and pedestrian traffic. It’s a reflective substrate that can be applied directly to streets, parking lots and driveways, and supports full-color graphics that can stand up to the rigors of vehicular and pedestrian traffic.

Mactac has launched IMAGin Simply Sustainable, a new line of PVC-free films that consist of polyester (PET) and polypropylene (PP) films that meet current regulatory standards of the U.S. Consumer Product Safety and Improvement Act (CPSIA). IMAGin Simply Sustainable products are primarily designed for window or glass surfaces but are versatile for other applications as well.

In other Mactac news, in February, the company acquired Spinnaker, which specializes in the customized production and distribution of pressure-sensitive roll label and sheet base materials in North America, expanding its footprint in the specialty label market.

That wraps it up for wide format. Cary, take it away…

Textile Trends: Some New, Some Ongoing

Like many industries, the textiles & apparel industry was thrown into disarray by the pandemic. Supply chains crumbled, damaging relationships between brands and manufacturers and making it difficult for retailers to keep inventory levels up. During the crisis, there was a great deal of talk about making major changes to the supply chain, including more reshoring or near-shoring of manufacturing, and acceleration of the adoption of digital technologies.

As the pandemic died down, so, too, did the urgency in restructuring the supply chain, or so it seems. That’s not to say that the supply chain is fixed. There are still lots of ships just sitting out at sea waiting for their turn to unload containers. And that contributes to longer lead times, shortages and substantial price increases for containers, and exponential growth in shipping costs. But as the backlog gets smaller, the sense of urgency seems to diminish as well.

Another casualty of all this is a focus on sustainability. That was a hot topic pre-pandemic. And certainly, there are many leading brands that are still working hard to make their products more sustainable. But as a long-time leader in sustainable practices, Patagonia, pointed out in a recent article, there are aspects of the design, manufacturing and distribution processes brands can control – and aspects they cannot.

One example Patagonia points out is that while they work hard to be as sustainable as possible, and despite the fact that recycled content comprises 68% of total usage, the company doesn’t really use the term “sustainable” anymore. The reason is “because we recognize we are part of the problem. Previously, we set ourselves the target of carbon neutrality by 2025. But purchasing offsets to get us there doesn’t erase the footprint we create and won’t save us in the long run. We must first put the weight of our business behind drastically cutting emissions across the full length of our supply chain. What is unsettling is that, right now, we aren’t entirely sure how to do this.”

And if Patagonia doesn’t know how, who does?

The size of the overall carbon footprint is partly, if not largely, dependent on the manufacturing process. Patagonia, and other small- to mid-sized brands, share manufacturing resources in Asia, and therefore do not have full control over what happens there from a sustainability perspective.

Pre-pandemic, we also heard a lot of talk about moving away from the wasteful "Fast Fashion" model of creating basically throwaway clothing. Now what we are seeing is more "Fossil Fashion," where more than 60% of today’s production of clothing uses petroleum-based feedstocks.

“The fashion sector is awash with certification schemes, sustainability labels and multi-stakeholder initiatives all seeking to steer the industry onto a greener course," according to a March 2022 report published by the Changing Markets Foundation (License to Greenwash). "As public and political awareness of the high environmental and social toll of the fashion industry has climbed the agenda, and scrutiny on brands has intensified, so has the visibility of certification schemes and voluntary initiatives pitched as holding the solutions.”

The report doesn’t so much throw shade on these important initiatives, such as The Ellen MacArthur Foundation, OEKO-TEX and others, as it does expose how some brands are leveraging the relative lack of accountability within many of these initiatives, which is "a key part of the greenwashing machinery of the modern fashion industry," according to the report.

A Focus on the Future

That being said, and because I don’t really want to be the new Dr. Doom, there is a great deal of activity focused on streamlining the supply chain, bringing sustainable manufacturing closer to the point of need, using sustainable materials and reducing waste—both in the manufacturing process and as garments reach the end of life.

While some major brands are pushing toward these goals, much of the work is being done by upstarts—a common phenomenon in any industry facing structural change. The upstarts have less to lose and more to gain by driving change, and they are not hobbled by “the way we have always done things,” and large, bureaucratic organizations.

Still, progress is slower than we would like. But our Technology Outlook Webinar session on textiles highlighted some of the encouraging trends we are seeing.

Fibers First

A key to sustainability in textiles is the types of fibers that are used to create fabrics. In the April edition of Printing News, we highlighted some of the terrific work that is being done in the development of new, innovative and more sustainable fibers, including:

HeiQ AeoniQ

AeoniQ is created from 100% natural cellulosic feed stock. It is not only a new fiber, but it is spun as a continuous filament. The goal is to provide the textile industry with a more sustainable solution with a smaller CO2 footprint and a reduction of microplastics pollution.

9FIBER

9FIBER is a start-up in the industrial hemp material converter space backed by 10 years of R&D. The company has patented a process for taking agricultural waste and hemp stalks and stems and converting them into two main ingredients: bast fiber, which is the outer skin of the plant, and cellulose, which is the inner or woody core of the plant. This eco-friendly degumming and decontamination technology allows the company to unlock the potential of this material and insert it into nine target markets, including textiles, creating multiple end products within those nine markets. It uses minimal water and no toxic chemistry.

TENCEL

TENCEL, a sustainable fiber developed by Lenzing, is celebrating three decades of fiber innovation. The fiber is derived from sustainably sourced renewable raw material wood and produced by environmentally responsible processes. Most recently, the company has added REFIBRA technology. TENCEL fibers with REFIBRA technology are identifiable in yarns, fabrics and final garments owing to the innovative special identification technology designed to confirm fiber origin. In turn, this improves supply chain transparency and contributes to a circular economy.

Kyorene from Graphene One

Kyorene Graphene composite fiber has bacteriostatic, mite repellency, UV resistance, deodorant properties, heat dissipation and increased mechanical strength functions. It can be widely used in knitted and woven fabrics and non-woven materials. It contributes to increased functionality and longer life cycles for textile-based products.

It should be noted that Graphene is being used in a number of ways in the textiles industry, including in inks and coatings, to provide additional functionality, including conductivity for wearables and other applications.

Careful Color

Conventional fabric dyeing and printing processes not only use lots of water but also contribute to water pollution and waste. In addition, these processes are designed for large batch operations and are not economical for the production of shorter, more distributed runs. That’s where digital printing comes in.

There have been major improvements in the quality and color fidelity for digitally printed fabrics, and of course, with digital printing, you can manufacture to order in quantities as low as one. Although this has the potential to completely revolutionize the fashion supply chain, digitally printed fabrics only comprise about 10% of the global total. That being said, we again have upstarts coming into the market that are not constrained by conventional processes that are leading the way to a more sustainable future.

There are many companies being established to achieve these goals. We will highlight only three of them here due to space constrictions.

BMC.Fashion, founded by Kirby Best and located near the Phoenix airport, includes two Kornit digital printers and four Gerber cutting tables. Best has distilled the manufacturing process to include the fewest physical touches, the most flexibility in sizing, and probably the largest use of robots for a truly innovative installation. He has a unique “seams-based” approach to training sewists, making it faster and easier to develop this critical talent, bringing it back to North America.

Founded by Justin and Diana Rammell in Salt Lake City, Raspberry Creek Fabrics not only offers direct-to-fabric printing using a wide range of designs, but has also patented a unique process for speeding up printing by automating the repeat process, which can bog down textile printers and slow throughput. The platform they have developed also lends itself to remote management, with a long-term vision of scaling up through establishment of multiple factories.

Catalyst Fabric Solutions, located in the Florida panhandle, was incorporated as a standalone company in 2016 to focus on on-demand production of interior and home décor as well as promotional items such as bags and backpacks. All of its printing is digital dye sublimation (heat transfer) along with a-sew operation . Its B2B customers can easily order through a portal for fast delivery (within 2–3 days) to end customers of blankets, towels, bedding, pillows, table linens and more. The company will also produce custom yardage on a variety of fabrics. Catalyst employs 200 people on average in its 300,000 square foot facility.

A Plethora of Printers

Printer manufacturers are stepping up with increasingly innovative solutions for digital textile printing, including direct-to-garment, direct-to-fabric, direct-to-film and dye sublimation heat transfer technologies. We’ll touch on the highlights here, again, due to lack of space, but applaud all of the manufacturers who are working hard to add scale and quality to digital fabric printing, an important key to a sustainable future

Epson has had great success with its Monna Lisa direct-to-fabric printers in Europe and has very recently announced its first foray into direct-to-fabric printing in North America with the Monna Lisa 8000 digital direct-to-fabric printer, announced May 17, 2022. The printer can be installed with pigment, reactive, acid or disperse inks.

CAPTION: Epson Monna Lisa 8000.

EFI Reggiani recently introduced three new printers: BLAZE, HYPER and TERRA Gold.

The EFI Reggiani BLAZE printer has been designed to give textile companies the opportunity to enter the digital textile printing market with a compact solution with cutting-edge printhead reliability and low maintenance costs for a competitive TCO (total cost of ownership) and smooth and precise material handling of knitted and woven fabrics.

EFI Reggiani HYPER is a model that—in a 3.4-meter size printing on two 1.5-meter rolls in parallel—can produce up to 20 linear meters per minute. That level of throughput is comparable to what some low-end single-pass textile printers produce.

And TERRA Silver with pigment inks is the latest addition to Reggiani’s TERRA printers that replace water-intensive steaming and washing with using a highly efficient polymerization process that goes into effect as printed textile goes through the printer’s on-board dryer. It’s an ease-of-entry solution enabling more businesses to get into the industrial printing segment.

CAPTION: EFI Reggiani BLAZE.

Kornit offers a wide range of direct-to-fabric and direct-to-garment printers and has recently been on an acquisition binge, adding workflow components to its total solution approach.

Most recently, the company has acquired Tesoma, globally recognized for the high-quality engineering and performance of its cutting-edge textile curing solutions; Custom Gateway, UK-based provider of cloud-based workflow solutions for on-demand production business models; and Voxel8, whose advanced additive manufacturing technology for textiles allows for digital fabrication of functional features with zonal control of material properties, in addition to utilizing high-performance elastomers adhering to inkjet technology.

The company’s goal is to build the leading operating system for on-demand sustainable fashion. The company also launched the Kornit Atlas MAX Poly system, a DTG solution for polyester and poly-blended apparel using Kornit NeoPigment Olympia inks.

CAPTION: Kornit Atlas MAX Poly.

Coloreel, while not exactly a textile printer, is still a technology well worth mentioning that is gaining steam in North America through its distributor, Hirsch Solutions. The company’s solution dyes standard white recycled polyester thread on demand to enable embroidery of complex designs never before possible, using a single embroidery head. This is a technology worth watching as more units are placed around the globe.

Ricoh announced its first direct-to-film printer, an enhancement to the Ri 1000 or Ri 2000 DTG printers. This expands the range of fabric types these printers can be used for. It offers more durability during washing cycles. DTF enables printing on cotton and synthetic fabrics without the need for pretreatment. It uses standard films and hot melt powder already available in the market. Existing printers are field upgradeable with software downloads. Operators can easily switch between DTG and DTF modes.

As mentioned in the signs section, Mimaki launched its TS330-1600 sublimation transfer inkjet printer with environmentally friendly ECO PASSPORT certified inks and a number of enhanced capabilities over previous members of this product family.

CAPTION: Mimaki TS330-1600.

We expect to see continuing innovations in digital textile printers going forward, from these manufacturers and others.

The Last Mile

While there has been significant progress in digitizing everything textile from design through cutting, sewing remains the “last mile” of automation and efficiency. Significant progress is being made in sewing automation, but most end products still require skilled sewists. Initiatives like ISAIC in Detroit, BMC.fashion in Arizona, and virtual training of both sewists and sewing machine mechanics using the Shimmy.io mobile apps are helping to grow the skills base in North America. We need more of these initiatives to bring more textiles and apparel manufacturing back to North America in any scale.

We covered these topics and more in our Technology Outlook Webinar on May 17. To access the archived recording—both slides and audio—visit whattheythink.com/webinars.