Buying A Used Press

The state of the used press market is varied across the globe and within different print sectors.

The state of the used press market is varied across the globe and within different print sectors.

In the North American newspaper market, for example, which has suffered such a sharp downturn in recent years, there has been a significant increase in used press sales, reported Eric Bell, director of marketing. Goss International. Across the US, Europe, and other developed countries, where the volume of equipment sales has slumped dramatically overall, the proportion that is used equipment and/or upgrade work is higher today.

On the commercial side, there is an increase in availability of used press equipment due to companies failing in the economic downturn. However, says Bell, “with the improving economy there has been an increasing amount of importation of late model used equipment coming in from Europe as well the exportation of older technology to developing markets in Asia and South America.”

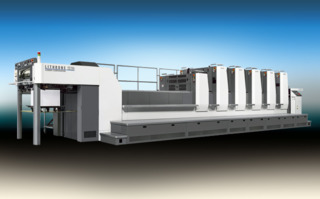

Komori America’s Robert J. Griesenbeck finds the market for used presses stagnant. “When we went through the big downturn of 2007-09, there was a glut of presses because printers were going under,” said Griesenbeck, who is the director, remarketed equipment. “The domestic market is the same as it has ever been.”

However, Griesenbeck commented, there are a lot of older, used presses put in containers and going overseas.

Heidelberg USA reports that US sales of its remarketed equipment have risen by 40 percent since 2012.

A used press can enable a customer who has limited investment dollars but is looking to update technology over what they currently have, to move into additional markets, or add additional capacity to an expanding market, said Bill Murphy, vice president operations and remarketed equipment for Heidelberg USA.

However, added Murphy, “if you need to compete with the most efficient providers in the market, you must buy new because the latest technology means the highest productivity.”

It comes down to money in relation to the size of the business, remarked Griesenbeck. If you are a $3-4 million print shop, buying a $2.3 million press is a stretch; a press that costs $1.2 million is a whole lot more palatable to a bank.

“One of our customers is a smaller-sized printer who is replacing two older manual presses with one newer press,” Griesenbeck said. “It’s huge uptick for him in capacity and productivity; it’s the same size press, but with H-UV drying and a lot more advantages in productivity. There is a huge difference in the amount of work generated off of the new (used) press vs. the older, manual presses.”

A used press may also be the solution when a printer has a short-term contract on specific types of work, and is unsure whether or not that work will continue. Or, if fast delivery and installation is required, vs. the four-five months required to take stock of a brand new machine.

The majority of Goss’ customers are looking, “to make a technological leap forward to improve capability and cost-effectiveness—and that means investing in new equipment; often investing in one new press system to replace two or more existing press lines,” said Bell. “With the level of competition in the market today, progressive printers who are looking to build and grow their businesses, rather than to just keep their head above water, are focusing on ways to improve efficiencies. There are some enhancements or features that can be added to a used press, of course, but essentially there are very few instances when you can make an older press perform as well as a new one.”

When buying a used press, the main issue is to trust the partner you engage with on the machine, said Murphy. “The company who will stand behind the transaction and who will be your partner for future equipment needs.”

Similar to buying a used car, you need to know the history behind the press. “The maintenance of the press is important and the overall general working condition of the press is vital,” Murphy said. “The installation process should be managed like a project similar to a new installation. Small details can make a big difference in the final outcome of the install.”

In the North American market, Heidelberg equipment purchasers are looking for presses with CP2000 control center, Autoplate plate-changing, and Alcolor Vario dampening system. “Also, the equipment must have an aqueous coater,” said Murphy. “Requests for UV capability have also been on the rise.”

Spectrum Marketing Companies in Manchester, NH, installed a pre-owned, 2011 Speedmaster XL 75 8-color 4/4 perfector with Axis Control to replace an earlier model Heidelberg Speedmaster, also pre-owned. Spectrum, which offers design, production, and logistics for direct mail marketing campaigns, as well as a full range of commercial printing products, was looking to turn work more quickly and respond to market demands with the purchase of the Speedmaster XL 75.

With fast makereadies and minimal waste a concern for all printers, Komori’s H-UV drying is in big demand, said Griesenbeck. “Whether buying a new or used press, the issue for printers “is how fast I can turn that sheet around,’” he stated. “With our H-UV technology, we can get it back through the press quickly for printing the second side, or, if the press is a perfector, you can get it to finishing immediately, with no marking problems.”

Additional technology customers require is AI, or Advanced Interface, which stores color changes made during makeready over time for automatic adjustments.

“It’s all about how fast you can get to a sellable sheet in a shorter time period, with less waste,” said Griesenbeck. With runs shrinking, and printers pushing through more jobs daily, running 10 jobs a day or more, being able to produce sellable sheets in seven minutes vs. 30 minutes is critical.

When buying a used press, you need to consider all the same things as when buying a new one but with the additional concerns of its history, said Bell. “If you compare it with buying a used car, you want to have some quantifiable and verifiable data on performance and productivity; you want how many miles it has on the clock.”

Things to consider:

- How many hours a day/week was it in operation?

- What was the average press downtime?

- How many people/different crews ran it?

- What is the cost and supply of parts and service like?

“In addition to these considerations, it’s important to think about the length of service you’re expecting from the equipment and whether the press will accommodate changes in production requirements over that period,” said Bell.

- What level of automation is there?

- How flexible is its design platform?

- Does it have an open-architecture system?

- Would it accept integration of new auxiliary equipment or processes?

- Does it address emerging environmental concerns or regulations?

“On top of all these, obviously, you also need to check the pedigree of any contractors you will engage for the relocation and reinstallation process,” said Bell. “Make sure they have a good track record and can provide guarantees of service and timeliness.”

Who you buy your press from is a big differentiator in the used press buying process. While dealers deal with multiple presses, manufacturers stick to selling their own machines. “It’s very different buying it from a manufacturer vs. a dealer, said Griesenbeck. As part of its KomoriKare program, the company conducts press performance audits (PPA), a full inspection of the machine.

“We only sell presses that are seven years old and younger,” he added, “and check even the smallest things when we sell.”

To ensure its customers are able to make use of the newer press’ advanced features, Komori provides two-to-four weeks of onsite instruction. Presses from the mid 1990s to 2000 don’t have the same level of automation that presses built from 2003-2012 have.

“The customer mentioned earlier is a smaller-size customer, who was growing and needed more throughput coming off the machines,” said Griesenbeck. “He went from a manual half-size press to a 2009 Komori LSX 29 press; it has the exact same technology as one of our brand new presses.”

Komori will also visit customers after the installation, to see how they are doing. “A dealer will get you going to you sign off on your first sheet and then they are done,” said Griesenbeck. “From our perspective, we also make sure the specs of the machine match the customers’ needs; we make sure they are not buying too much press, but certainly not buying too little; in terms of units, speed, and technology.”

Goss International, says Bell, is circumspect about dealing directly in used presses, “as we have a hard-earned and highly-cherished reputation to uphold. We only perform a direct sales role for presses we have completely overhauled and refurbished because it is only in these cases that we can legitimately guarantee the condition of the equipment as well as provide warranties for new parts, etc. More often, customers buy their used presses direct from the vendor and engage us to provide relocation, installation, upgrade, and commissioning services.”

Heidelberg has been expanding its used equipment-buying program over the past 24 months. “We look to purchase from end customers, leasing companies, banks, government agencies—even companies we are in contact with through our vast international network,” says Murphy. “This allows us to purchase the right equipment for our individual market or individual customer. The ability to purchase with the strength of Heidelberg gives confidence to the seller that the transaction will go smoothly, with the support of a trusted partner.”