Labels and Packaging - 2022 Tech Outlook

Labels and packaging went through the pandemic strong, and came out of it even stronger. Some of that growth was a movement from analog to digital production to address the shifting consumer purchasing behaviors.

Labels and packaging went through the pandemic strong, and came out of it even stronger. Some of that growth was a movement from analog to digital production to address the shifting consumer purchasing behaviors, including an increase in product segmentation, mass customization and personalization.

Labels and packaging have been able to skirt much of the paper and labor availability pressures seen by commercial print, but supply chain issues in general seem to leave no one untouched.

The effects can be seen in the availability of machine components as well as consumable availability and increased costs, however equipment vendors and converters are still producing despite the pandemic response in China and the turbulence in Eastern Europe. So what do we have to look forward to in 2022 and beyond?

The Market

Packaging is essential to both good and bad market conditions, and it will continue to play a major role regardless of pandemic disruptions or regional conflicts.

Population growth is higher in emerging regions like Africa, Asia and the Middle East, but it is showing moderate projected growth in North America and Western Europe as well.

The use of more individual packaging in place of bulk is growing, and online purchasing of goods has driven the demand for new packaging and repackaging options.

Consumers are now demanding, and regional governments are enforcing, more efficient and sustainable production methods to reduce the net impact on the environment. This includes reduction of energy use, harmful exhaust and waste in manufacturing and a more circular and low-carbon economy in packaging.

As a result, both the equipment as well as the packaging components and processes are changing to address the purchasing and sustainability demands.

Product Innovation

Labels

Label volumes are continuing to grow, and flexo still accounts for the majority of label production, however the higher growth rates are seen with digital print technologies including electrophotographic, inkjet and hybrid flexo (all in one) inkjet production.

In the electrophotographic space, HP has been shipping their Indigo 6K and 8K liquid toner label press, and is going to beta with their "Series 6’"technology Indigo V12 this summer to a customer in EMEA, with other beta units not far behind. This new technology will present the fastest electrophotographic production rates for six colors at 120 m/min (400fpm) and more than six colors at 60 m/min, designed to compete with narrow web flexo.

Photo: HP Indigo V12

Photo: HP Indigo V12

Xeikon has a significant market share of toner label presses, including their CX300 Cheetah dry toner press, which supports swappable colors and can include metallic gold and silver toners, which fit in the fifth color station. They have also been shipping their PX3000 Panther UV Inkjet press series, which prints at 70 m/min (230 fpm) equipped with up to eight colors. The recently launched next generation label converting units can include varnish, spot varnish, laser die-cut, hot foiling and screen printing in addition to rewinding.

Photo: Xeikon PX3300

Photo: Xeikon PX3300

Recently introduced hybrid presses, also known as "all-in-one" presses, include the Bobst Digital Master series in narrow- and mid-web widths. They can print up to 100 m/min and be configured with six UV colors plus digital white. It uses the Bobst Mouvent Cluster imaging and their configurable M5 flexo platform.

Other all-in-one presses include the Canon LabelStream 4000 UV inkjet press, which uses an imaging station initially developed by FFEI and a transport developed by Edale.

Mark Andy has a number of all-in-one presses, including Digital Pro, Digital Series iQ and the Digital Series HD, which is designed for future growth.

Durst offers their RSC line of press, which were developed in conjunction with OMET, the flexo press manufacturer.

Photo: Bobst Digital Master

Photo: Bobst Digital Master

Flexible Packaging

The increased use of flexible packaging provides many benefits throughout the supply chain. It minimizes package transport costs, takes up less space when empty, and can be constructed on the spot from roll materials at the filling location. It also offers better opportunities for reuse and recycling. As a result, it is the fastest growing segment of packaging types.

The majority of flexible packaging is being produced flexo with gravure still producing some of the longer and more consistent production.

Some label converters are using their narrow web presses to produce flexible packaging, but this is a growing area for specifically designed digital solutions with HP and Xeikon jockeying for early dominance of the short-run flexible packaging market.

To compete with Flexo on the longer runs, SCREEN is going to beta with their Truepress PAC830F aqueous flexible packaging press. This will compete with the UTECO/Kodak Sapphire EVO W.

Fujifilm also announced their J Press FP790, which is anticipated be installed in beta later this year.

The modular Koenig & Bauer RotaJET and RotaJET, are starting their beta cycles that are designed to support a wide variety of media and could be targeted at flexible packaging.

Photo: KBA RotaJET

Photo: KBA RotaJET

Folding Carton

The bulk of carton printing is still produced offset, with flexo and gravure accounting for still significant amounts.

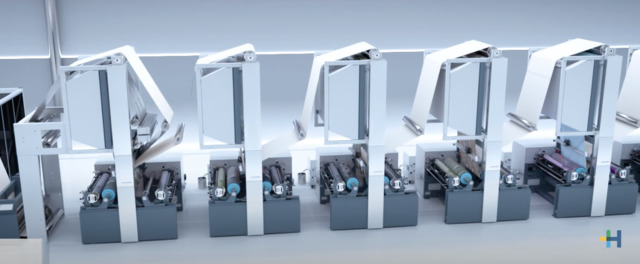

With Heidelberg, Koenig & Bauer and Komori digitalizing their offset presses, you can expect that offset print will be a viable competitor for carton work. One of the more anticipated folding carton solutions is the Heidelberg Boardmaster, a high-speed wide flexo press with on-the-fly job changes and lots of digitalization. This is expected to go into beta later this year.

Photo: Heidelberg Boardmaster

Photo: Heidelberg Boardmaster

Digital carton production is growing to address the shorter-run mass customization market and is projected to show significant growth in the future.

Many of the current digital offerings are B2 or B2+ format, including the HP Indigo 35K, Fujifilm J Press 750S and the Konica Minolta AccurioJet KM-1e.

In the B1 format, the Koenig & Bauer VariJET 106 and Landa S10 are currently the two primary players that are shipping. The MGI AlphaJET, a modular complex production flow system has finally gone to beta after a long development cycle, and the newly introduced Speedset from Inca (now an Agfa company), which has been announced but probably won’t be going to beta until late 2023.

Photo: MGI AlphaJET

Photo: MGI AlphaJET

Corrugated

Corrugated is used for packaging and for in-store display and is the largest volume packaging type.

Flexo maintains the healthy volume of corrugated production, with offset and gravure still holding a declining percentage. Much of that decline can be attributed to the growth of digital corrugated production presses. Higher performance offset presses by Heidelberg and Koenig & Bauer are holding back some of that technology transfer.

To address the mass customization market in the digital preprint space, the HP T470S and the T1190 compete with the Koenig & Bauer VariJET, which offers a preprint alternative to their CorruJET postprint solution.

Digital Postprint corrugated production is seeing a lot of growth and an increase in available solutions. These include the HP C500 with the new innovated top feeder, the updated EFI Nozomi C18000 Plus and the recently introduced Nozomi 14000 LED and the Barberán Jetmaster. The Xeikon’s IDERA and the Domino X630i are out of development and now both installed in North America and other regions.

Photo: Domino x630i

Photo: Domino x630i

Bespoke

Component Inkjet technologies from print heads to print bars and full printing systems by Memjet, Dimatix and XAAR will continue to drive the increase in bespoke packaging production solutions, both standalone and integrated with manufacturing lines. And while each of them has been providing imprinting solutions for personalization, track and trace and security, they are now offering full-color inline solutions for product manufacturing.

Converting/Finishing

As the saying goes, printing is not finished until it is finished. Obviously the same goes for packaging. Digitalization of finishing and converting equipment is increasing to keep up with the requirements of digital print. While much of the same equipment, like die cutters and folder gluers that are already installed in converters facilities could suffice, the volume of shorter runs really demands a better suited solution.

Companies like SEI and Highcon have been marketing digital die cutting solutions for a few years. Semi Rotary die cutting inline on hybrid and all-in-one flexo presses are becoming standard fare. Bobst just introduced the Mastercut 1.65 PER, a folder gluer designed to satisfy the requirements of digital retail.

When it comes to embellishment of roll media for packaging, ABG has the most flexible systems to compliment digital label and packaging finishing. The modular design of the Digicon Series 3 units provide the needed flexibility to target the specific application(s) of a converter, and they provide a high degree of automation.

Automation in converting and finishing is becoming even more important now that it is harder finding and holding employees in these labor-intensive applications. Robots to the rescue!

While a few years ago this would have been considered a joke, today there are many companies that will tailor robots to do all types of manual processes from moving paper to feeding finishing machines. Surprisingly the costs are becoming very easy to justify and ROI. In many cases if there is a laborious task that requires an employee over the course of two shifts, the ROI can be less than two years.

Industry 4.0 (i4.0)

We have been talking about connecting supply chains through industry 4.0 and the ubiquitous cloud. We are finally seeing solutions from many of the hardware manufacturers and others. These solutions include various AI functionality and reporting and are getting more sophisticated as more machine data is being logged into the cloud. If there is a looming problem it is that each vendor is doing it on their own without any real standardization other than programming languages like XML, JSON and individual APIs. Since almost all production facilities have disparate solutions, this will undoubtedly create integration challenges.

Acquisitions and Partnerships

As packaging continues to change and grow, the opportunities for development increase and become more attractive for investment. While acquisitions are not new, as a result of growth and consumer demand changes, we are starting to see lots of partnerships, joint development, rebranding and acquisitions of equipment and software companies in the packaging ecosystem.

The recent acquisition of Edale Ltd. by Canon could provide a new flexibility to develop a wide range of label and flexible packaging production systems. As does Afga-Gevaert, recent acquisition of Inca Digital Printers, previously a part of the SCREEN Graphic Solutions Group which also has the potential for significant new product and solution development. In software, we saw the acquisition of IC3D by the expanding Hybrid Software (formerly Global Graphics), which is increasingly becoming the platform of for inkjet system development for many as a result of their integrated and highly productive Smart DFE.

Partnerships across equipment vendors offer quicker time to market and reduced development cost and load, and it is increasing. Durst and Omet, Heidelberg and Ricoh, Durst and KBA, Xeikon and Shenzen Hanway, Domino and Sun Automation Group, Mark Andy and Domino, the list goes on and on. These partnerships allow manufacturers to add value and "tailor the press" to their requirement beyond just painting them.

More to Come …

I would like to address your interests and concerns in future articles as it relates to the manufacturing of Print, Packaging and Labels, and how, if at all, it drives future workflows including ‘Industry 4.0’. If you have any interesting examples of hybrid and bespoke manufacturing, I am very anxious to hear about them as well. Please feel free to contact me at [email protected] with any questions, suggestions or examples of interesting applications.