Production Inkjet: Welcome to the Revolution—Let’s Talk Corrugated

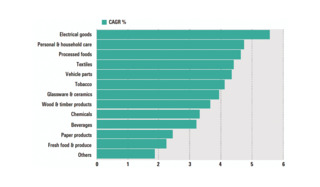

One of the hottest topics in packaging print today is corrugated, and for many reasons. The estimated total of all corrugated boxes produced in the US is approximately 100 billion per year with e-commerce being the big growth driver. Amazon alone is estimated to be shipping about two million packages a day including padded envelopes—and growing. Overall, it is a market area that is showing a solid growth trajectory. Smithers Pira projects the global market will increase strongly at an average of around 3.7% CAGR to reach 170 million tons, and approach $300 billion in 2023.

Growth prospects for corrugated board 2018–2023 by end use

©Smithers Pira

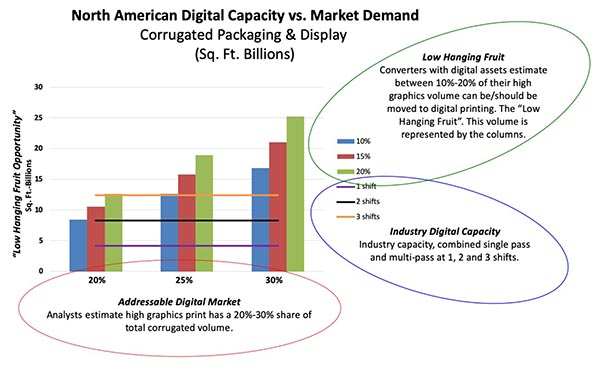

According to a recent and ongoing study by Karstedt Partners, if you break these numbers down a bit to focus on high graphics production, or those corrugated pieces with three or more colors, we are looking at roughly 20% to 30% of the total. That would include corrugated boxes and displays. Breaking it down further, in that same study, they found digital printing accounts for about 10% to 20% of the high graphics production total. However, putting it in perspective, digital packaging is still only about 3.33% of all printed corrugated packaging (one color up to and including high graphics) and perhaps a little over 2% of all corrugated packaging, since there is so much non-printed. That would seem to suggest opportunity.

So, what are the areas of growth, and some of the challenges that will affect the growth of digital print, more specifically production inkjet, in corrugated?

Corrugated printing is not new by any means, but there has been a significant increase in the use of corrugated in general and high graphics in particular. The corrugated market, like much of the label and packaging in general, is going through many changes. Much of that is driven by market changes driven by consumer preferences and product manufacturers’ desire to address those new requirements. Those new requirements primarily translate into mass customization and the “promise” of mass personalization. Beyond that there is the growing understanding that high graphics in corrugated, very much like labels and other forms of packaging, produce a “wow factor” to help differentiate the product on the shelf or in an engaging unboxing experience.

So where are we today as an industry? Let’s start with the installed base of presses to currently support this growth. The Karstedt study found approximately 33 single-pass and 70 multi-pass presses are installed in North America. While high-volume production inkjet multi-pass presses like the HP T400S and HP T1100S have been around for a longer period of time, the HP C500 and the EFI Nozomi C1800 single-pass presses are just starting to find their way on to the production floor. Additionally, the lower-volume multi-pass production inkjet solutions from HP Scitex and EFI VUTEk have been in the mix for a while. Although, to the brand owners, this is still a “new market technology,” and it will take some time for them to fully understand the value and execution philosophy to take advantage of it. So, for the short term the question is: do we have more capacity than demand?

©Karstedt Partners

The Karstedt study identifies litho laminate and litho label as the “low hanging fruit.” The chart plots capacity against demand from a 10% to 30% high graphics volume. As you can see, even at 30% high graphics volume demand, it is only hitting about 25% of the total available production capacity. However, this can be a bit misleading. What the study has found, and what we have seen in other digital transitions, is that when you add the flexibility of a digital machine to an analog production plant, you are able to shift your production mix around to keep the plant as a whole, analog and digital, better optimized and also address the increasing demands of shorter turn times.

Another challenge for production inkjet in corrugated is coming from the rebirth of flexo, which I have covered in the past. I recently had an opportunity to see the Bobst THQ FlexoCloud solution, which is impressive and can be combined with other digital flexo technologies to create strong competition in high graphics corrugated directed at mass customization. I will cover the Bobst THQ offering in detail in a future article.

There is no doubt that production inkjet will continue to address the increase in high graphic corrugated volume demand, however there are, and will continue to be, challenges along with those opportunities.

More to Come …

I would like to address your interests and concerns in future articles as it relates to the manufacturing of print, packaging and labels, and how, if at all, it drives future workflows including “Industry 4.0.” If you have any interesting examples of hybrid and bespoke manufacturing, I am very anxious to hear about them. Please feel free to contact me at [email protected] with any questions, suggestions or examples of interesting applications.