Inkjet Outlook - Interesting Times Ahead

There is no question that we are living in interesting times and nothing is quite as we might have expected at the end of 2019. The production inkjet market is no different. In looking at the "Inkjet Technology Outlook for 2020" and beyond, it’s helpful to look back at 2019 and how we might expect to recover.

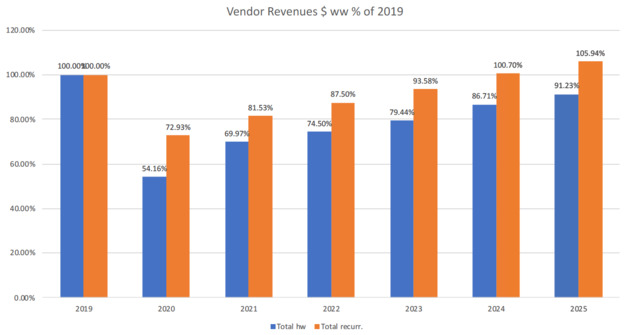

At the end of April, I.T. Strategies published "Digital Production Print Markets: Financial Models for The Coronavirus Recession," which looks at many economic factors to propose a potential timeline for the pace of digital print equipment investment to return to 2019 levels. While the report was developed for a world-wide OEM audience, the reporting of “recurring revenue” for the OEM can be seen as a proxy for the return of overall print volumes.

The report provided projections on both a “V-shaped” and a “U-shaped” market recovery with the former being both more positive and more likely.

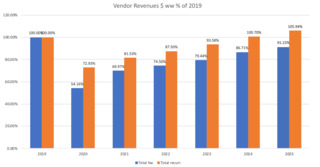

Table 1. Worldwide - All Digital Print Markets as Percentage of 2019 Value

Table 1. Worldwide - All Digital Print Markets as Percentage of 2019 Value

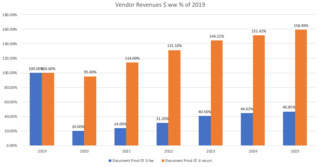

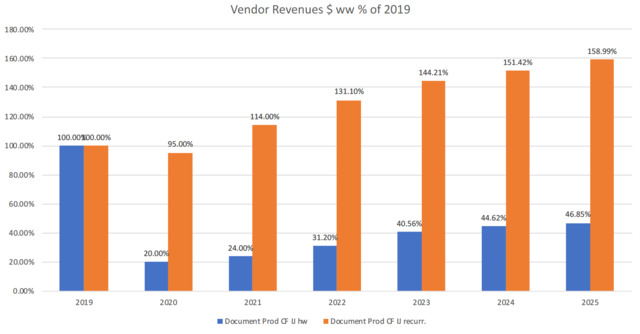

I want to emphasize that all of these tables represent the worldwide market. The U.S. print market and the economy as a whole was stronger than most other regions coming into 2020 and may experience a quicker recovery. Also specific segments, such as packaging and labels are likely to recover more quickly. Interestingly, the projected recovery trajectory also varies by platform. The continuous feed inkjet market for production documents is a relatively mature one in segments other than commercial print. Emerging segments, such as graphic intensive commercial print applications are very cost sensitive and will be slower to consider high capital outlay. This is reflected in Table 2, which shows recurring revenues (a proxy for print volumes) snapping back very quickly as the existing inkjet users in mature markets come back on line. Also consider that one of the largest segments of this market, transaction printers, never went dark and may even have seen a bump in volumes.

Table 2. Worldwide Continuous Feed Inkjet Print Market (Production Documents) as Percentage of 2019 Value

Table 2. Worldwide Continuous Feed Inkjet Print Market (Production Documents) as Percentage of 2019 Value

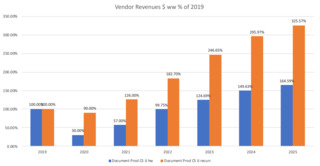

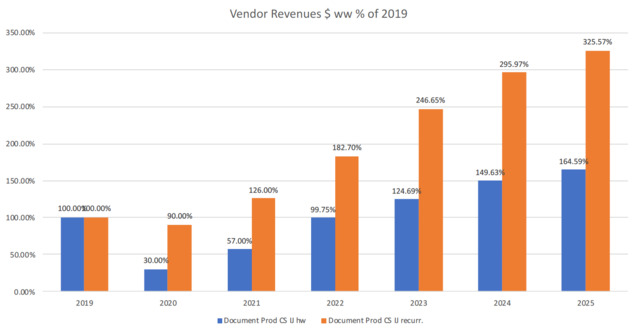

By contrast, cut-sheet or sheet-fed inkjet equipment investment is projected to bounce back more quickly than continuous (see Table 3) and to continue to grow by double digits year-over-year. While sheet-fed inkjet is a less mature market than continuous, for all but the B-1 format, sheet-fed is on average a significantly lower investment reach than continuous.

Table 3. Worldwide Cut Sheet (Sheet-Fed) Inkjet Print Market (Production Documents) as Percentage of 2019 Value

Table 3. Worldwide Cut Sheet (Sheet-Fed) Inkjet Print Market (Production Documents) as Percentage of 2019 Value

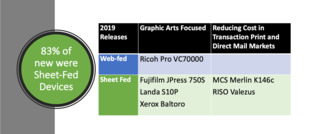

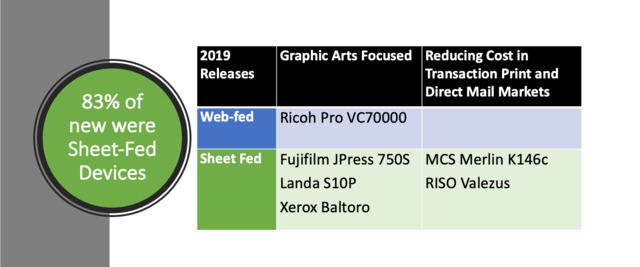

Looking back at 2019 product releases can also shed some light on the variations in momentum. Last year, new introductions in inkjet were focused on four major areas:

- Continued expansion into commercial, graphic arts markets

- Driving down costs in more mature inkjet markets

- Opening up the labels and packaging segment

- Continued development of hybrid inkjet presses across all segments

Our focus for Tech Week was on the first two of those items, since David Zwang prepared excellent coverage of the labels and packaging segment. It’s notable that the majority of the launches in 2019 focused on the sheet-fed inkjet market. (Details on each of these devices can be found on the Inkjet Insight Device Finder at InkjetInsight.com)

This is a fairly robust list of product releases for a year in which we might have expected OEMs to hold back some releases for drupa 2020. It’s interesting to note that over 80% of new device releases where sheet-fed. While Screen and Canon offered some significant upgrades to their continuous web offers, the Ricoh Pro VC70000 was the only major new web-fed device introduction. As we entered 2020, and drupa 2020 was postponed until 2021, OEMs needed to rethink their launch strategy. There are device announcements planned that are general knowledge, but analysts like me have signed nondisclosure agreements that prevent us from writing about them, so we are waiting for drupa 2021 to talk about things we learned about in 2018. Interesting times!

The notable exceptions are new device announcements from HP and Canon, both of which are targeting the graphic arts market with web-fed and sheet-fed offers respectively.

HP PageWide Web Press T250 HD and Brilliant Ink

In March, HP announced the HP PageWide Web Press T250 HD and Brilliant Ink. The new Brilliant Ink and HP Optimizer fluid enhancements open up the range of stocks and coverage options as compared to previous PageWide Web presses by eliminating the need for two separate fluids to enable compatibility with porous and non-porous media. Selective jetting of Optimizer, rather than anilox application, also reduces fluid use and enables higher ink coverage. When printing on ColorPRO certified inkjet media with Brilliant Ink, Optimizer is not required.

In addition, the T250 HD offers native resolution of up to 2400 dpi with dual drop weights to simulate a grayscale head. The T250 HD press operates in three speed modes:

- Quality Mode: 2400 dpi with dual drop weights at speeds up to 250 feet (76 meters) per minute. This mode delivers the highest quality for the press using dual—low and high—drop weights.

- Performance HDK Mode: CMY 1200 dpi (single drop) with K at 2400 dpi (dual drop) at speeds up to 500 feet (152 meters) per minute

- Performance Mode: 1200 dpi, single drop weight at speeds up to 500 feet (152 meters) per minute

The press has a web width of up to 22 inches (559 millimeters) and a print width of up to 20.5 inches (521 millimeters) and, similar to the T240, should support media weights of 40- 250 grams per square meter and up to 10 pt. It will ship with an inline spectrophotometer system.

A cornerstone of HP’s strategy, and one which can extend development timelines, has been maintaining an upgrade path for existing customers. HP will provide an upgrade path to the T250 HD and Brilliant Ink on a platform-by-platform basis beginning with the T200 installed customer base. Estimated upgrade costs run at around 15% of the cost of a new press. The new presses are expected to begin shipping by the end of 2020.

Canon VarioPrint iX Series Sheetfed Inkjet Presses

In April, Canon announced two new devices based on their iSeries sheet fed line. The VarioPrint iX3200 and the iX2100 are the same in all respects except speed producing up to to 10 million and 7 million A4 impressions per month respectively. Customers can upgrade from one to the other with a license fee, however there is no upgrade path from the current iSeries/iSeries+ to the iXSeries.

The key advances of the iX series over the iSeries are:

- Native resolution of 1200 dpi as compared to iSeries+ at 600dpi

- Updated inks to support new printheads

- Expanded media range (60 – 350gsm/40# text – 130# cover uncoated and 90 – 350gsm/60# text – 130# cover offset coated)

- Instant media switching with a printer input module supporting four trays of up to 4,500 sheets (with ability to connect multiple PIMs for max of 13,500 sheets in 12 trays)

- Enhanced drying to enable high coverage

- Improved registration control

- A post-fixation unit using instant heat combined with humidity to stabilize the humidity level of the paper stable and maintain flat print which is critical for perfecting and finishing

The combination of new heads and inks firing smaller droplets also enables a speed increase of approximately 8%, but more importantly the iX series devices will run mixed media jobs at full speed, which was a challenge for earlier iSeries models. Like the previous models, the iX series use ColorGrip spot-delivered primer to enable compatibility with a broader range of media.

Canon will continue to market the iSeries+ in the appropriate market segments while focusing the iX Series devices on the more demanding commercial printing segments. The first device was targeted for installation in Europe in May with rollout in the U.S. in the third quarter.

Looking forward to 2020 and beyond, we expect to see additional market entrants focused on the high-end commercial printing market. Komori announced their Impremia NS40 B1 sheet-fed press in 2019 and plans to finally unveil it at drupa 2020.

Driving continued innovation starts with the components of the finished devices including print heads, RIP software, DFEs and drying systems. It’s interesting to note that while we see continued innovation and partnership from companies like Memjet, several OEMs including Ricoh and Xerox have moved toward verticalization of their offers and away from using third-party print heads.

Another area where we expect to see significant activity heading into the re-deployed drupa, is hybrid inkjet or retrofit printing. Hybrid systems like the Colordyne 3600 Series AQ – Retrofit Printer which is powered by Memjet, allows the customer to get more value out of existing equipment by enabling pure digital jobs, traditional jobs and mixed work, all without increasing labor costs.

As production inkjet hardware and software components become more readily available for bespoke development, we expect to see an uptick in business for inkjet integrators and emerging OEMs to drive specialized solutions to the market.