2020 Top 100 Printers

Each year, Printing News invites small commercial print business owners to participate in our "Top 100 Shops Survey." The key word is “small." We set an upper limit for participation at $25 million in annual revenues. Our Top Shop this year just barely made the cutoff at $24.99 million, although one suspects they’d have been perfectly happy to be over the limit!

In 2019, the shops included in our Top 100 list accounted for more than half a billion dollars in revenue— $549,411,144, an increase of 9.3% from 2018. However, sad to say, a certain mitigating factor will likely prevent most shops from seeing any kind of increase in 2020 revenues. If we look at revenues for our top shops, three out of 10 (31%) said 2019 saw a 10%+ increase over 2018—but, not unexpectedly, that same amount are expecting a 10%+ decrease in 2020 compared to 2019.

The theme of this year’s Top Shops survey was unfortunately, COVID-19. We conducted our survey in March and April, so the survey responses reflect an industry in the midst of the crisis. The top six shops were all coping with the crisis in different ways, all of them successfully. (This could very well be why they are “Top Shops.”) Although the crisis obviously doesn’t retroactively affect their 2019 revenues, some of the initiatives that made them this year’s Top Shops have contributed to their successful battling of the crisis, even if the crisis has forestalled initiatives and plans for 2020.

Demographics

One company in our Top 100 spans three centuries—Zander Press, founded in 1899. The newest company in our Top 100 is Sir Speedy Tampa, founded in 2017. The median founding date for all companies in the Top 100 was 1986.

The majority of our respondents have one location; some of the franchises reported as many as 28 locations (AlphaGraphics). In the Top Six, two locations is the average. In terms of employees, our Top Shop this year (Firespring Print) topped the list at 154 (148 of them full-time). The mean number of employees for all 100 shops is 29 (median 22).

Applications

Color digital printing/copying is performed by 84% of respondents and accounts for, on average, 23.3% of shops’ revenues. Four-color process color printing is performed by 63% of respondents, and accounts for 17% of revenues. Wide-format printing (>36 inches) and signage are performed by 83% of respondents, and wide-format printing accounts for 11.9% of revenues and signage accounts for 9.7%. Binding and finishing are performed by 89% of respondents, but only accounts for 9.6% of revenues.

We asked our respondents about the extent to which they had been adding—or planning to add—various kinds of technologies and services.

- High-speed production inkjet (like HP PageWide, Canon Océ ColorStream/ImageStream)—22% of our Top Shops have added high-speed production inkjet in the past two years, 13% plan to add it in the next 18 to 24 months, 50% have no plans to add it, and 6% will outsource it if they need to.

- Wide-format printing (like signs, displays, banners)—73% of our Top Shops have added wide-format printing and/or signage in the past two years, 7% plan to add it in the next 18 to 24 months, 15% have no plans to add it, and 4% will outsource it. Most shops that have ever been likely to add wide format have added it—and it remains a high-growth, highly profitable business for them.

- Textile/fabric printing for soft signage—only 9% of our Top Shops have added textile printing for soft signage in the past two years, and 15% plan to add it in the next 18 to 24 months. Soft signage is not a big priority for our Top Shops, at least in-house: 46% have no plans to add it, but 22% will outsource it if they need to. Soft signage is such a potential growth area that this is really a missed opportunity for our Top Shops.

- Textile/fabric printing for garment printing/decorating—12% of our Top Shops have added textile printing for garments in the past two years, and only 3% plan to add it in the next 18 to 24 months. This is less of a priority than soft signage: 53% have no plans to add it, but 27% will outsource it if they need to.

- Direct-to-garment printing—9% of our Top Shops have added direct-to-garment printing in the past two years, 6% plan to add it in the next 18 to 24 months, 53% have no plans to add it, and 25% will outsource it. This is another missed opportunity, and promotional items like T-shirts, tote bags, etc., are in high demand. That said, these kinds of items (and the specialty items discussed in the next bullet point) are heavily tied into events, which are on hold for the time being. But when events start to take place again, there will be a pent-up demand for these kinds of items. (During the current crisis, custom-printed face masks are a high-growth area, and if re-opening stipulations require masks to be worn in public spaces, could continue to be a growth area.)

- Specialty or industrial printing (like coffee mugs, golf balls, smartphone cases)—11% of our Top Shops have added specialty or industrial printing in the past two years, 8% plan to add it in the next 18 to 24 months, 45% have no plans to add it, but 30% will outsource it if they need to.

- Corrugated packaging printing—4% of our Top Shops have added corrugated packaging printing in the past two years, only 4% plan to add it in the next 18 to 24 months, 61% have no plans to add it, and 26% will outsource it. In our three or four years of asking this question on various surveys, we have never seen abundant interest in corrugated or other kinds of packaging.

- Folding carton printing/converting—Likewise, only 5% of our Top Shops have added folding carton printing in the past two years, 7% plan to add it in the next 18 to 24 months, 59% have no plans to add it, and 22% will outsource it.

- Flexible packaging printing/converting—A scant 1% of our Top Shops have added flexible packaging printing in the past two years (and no one in the past year), although 8% plan to add it in the next 18 to 24 months. Still, 62% have no plans to add it, and 23% will outsource it. Of the various kinds of packaging, flexible packaging is the least likely to be pursued by general commercial printers.

- 3D printing—4% of our Top Shops have added 3D printing in the past two years, 5% plan to add it in the next 18 to 24 months, 69% have no plans to add it, and 11% will outsource it if they need to. We expect interest in 3D printing to start to increase this year, especially as entry-level machines (such as recent introductions from Mimaki) lower the barriers to entry. At the same time, 3D printing of personal protection equipment (PPE) during the current crisis has raised the profile of 3D printing.

- Printed electronics—Finally, only 1% of Top Shops have added printed electronics, and only 1% plan to. Three-fourths (74%) have no plans to add it, and only 9% are even interested in outsourcing it. Unlike some of the items on this list, we don’t really see printed electronics as a major opportunity (remember 15 years ago when everyone was going to be pumping out RFID antennas?), but smart labels and smart packaging could represent unique opportunities for those eager to pursue it.

As has been the case for the past couple of years, wide-format printing has penetrated pretty far into the small commercial printer market, and as we’ll see below, shops see substantial opportunities in wide format and signage. Other kinds of specialty printing are still on the lukewarm side, but as we come out the other side of the crisis, we will likely see some movement in these areas, especially if their customers have a demand for those kinds of items.

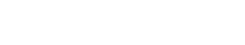

Top Challenges

When we look at the list of top challenges, we first need to have a look at the 18% who selected “other,” which consists almost exclusively (but not entirely) of “COVID-19.” The current crisis is also reflected in the top two challenges—national and local economic conditions (selected by 72% and 62% of our Top 100, respectively). After that, the more “evergreen” challenges like finding qualified sales people (34%) and capabilities of sales personnel (30%) start to show up. The big differential between the top two and the rest reflects the extent to which the current crisis is weighing on everyone’s mind. No one is sure what “normal” will look like, but in some ways, we’ll know we’re back to normal when print business owners can start griping about their sales guys again.

Top Opportunities

For most of the industry, things are kind of on hold at the moment, but in my conversations with some of the Top Shops, they had certain initiatives planned for 2020 which they will get right back to pursuing once things get remotely back to normal. As a result, the survey doesn’t reflect a lot of perceived opportunities at present, with the top item—hiring new salespeople—only selected by 37% of respondents.

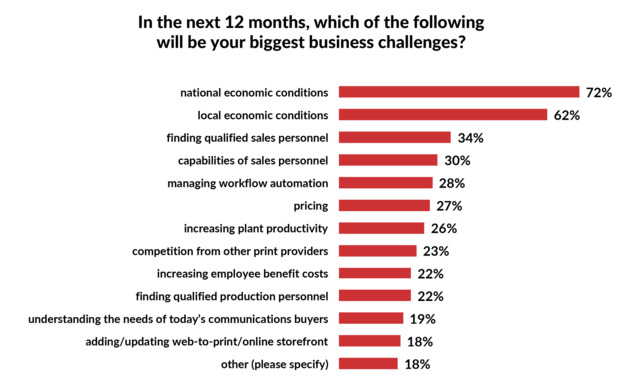

Planned Investments

We know from other surveys we have conducted that investment plans for 2020 are on hold at present, although our WhatTheyThink "Fall 2019 Business Outlook Survey"—conducted before anyone had heard of “coronavirus”—found that the majority of print businesses had no substantial capital investment plans for 2020. So we’re not that surprised that the top investment item for our Top 100—workflow automation software—was only selected by 20%. Indeed, many shops are finding that this is a good time to make needed improvements in production infrastructure and workflow.

Looking Forward

How this year will end is still—as of this writing in early May—very much up in the air. As I have spoken to our six Top Shops, the feeling is one of cautious optimism. These print businesses are not immune from the current crisis, and are bullish on things getting back to relative normalcy in a reasonable period of time.

The Top 6

#1 Firespring Print

For the second year in a row, we congratulate CEO Jay Wilkinson, COO Kevin Thomas and the staff of Firespring Print (www.firespring.com) for coming in at number one in our 2020 Top Shops, with 2019 sales of $24,994,812, up 3% from 2018. Founded in 1992, the company has two Nebraska locations—Omaha and Lincoln—and 154 employees.

“We were really happy with how 2019 went for us,” Wilkinson said. “We didn’t have as steep a growth as we’d had in previous years, but we shored up a lot of aspects of our business, especially in marketing services, in the branding, design and strategy work we do essentially as a print marketing agency. That work has stabilized, and while we didn’t have massive growth in revenue, we did experience substantial improvement across the board and in our profit margins, which was the focus for us.”

Firespring started in 1992 as strictly a printer—as an AlphaGraphics franchise, actually. In 2000, Wilkinson bought out the franchise agreement, he said, “to be able to pivot our company to be able to offer more products and services, because the internet had started to grow and we wanted to do website development and marketing services.”

Since that time, Firespring has evolved the marketing services side of the business, an emphasis that has led to clients wanting help with creating archetypes and persona development.

“In 2019, we tripled, if not quadrupled, the business that we did specifically in helping our clients with their marketing by developing archetypes, which is helping them understand their natural ethos, their natural wiring as a company,” Wilkinson said. “Every company has DNA that that makes them a little different than others. So we develop archetypes for each business and then we develop personas that make it easy for them to understand to whom to communicate and how to communicate to those people so that they’re consistent.”

Wilkinson is looking forward to regaining the momentum once the crisis passes, and Firespring, like just about everyone else in the industry, is managing as best they can.

“Our revenue is down about 30%,” Wilkinson said, “and we have had to do an across-the-board reduction in compensation for all of our salaried team members and reduced hours for all of our hourly team members. We’ve spread it out and have been able to navigate through with no layoffs or furloughs.”

As you can tell from this issue’s cover image, the teams also meet virtually on Zoom.

One of the things that Wilkinson is especially proud of, and is a primary focus, is Firespring’s continued drive to use the work that they do to make a positive impact in their community.

“The thing that we hang our hat on, that we spend so much of our time, effort and focus on,” Wilkinson said, “is our ‘Power of Three’ program, where we give 1% of our top-line revenue back to nonprofits in our community, 2% of our products and services—mostly print and marketing—to nonprofits that need help and 3% of our people—every team member volunteers one full day every month for the nonprofit that aligns with their personal mission or passion.”

In 2014, Firespring became certified as a B or Benefit Corporation, which meets the highest standards of verified social and environmental performance, public transparency and legal accountability to balance profit and purpose.

According to Firespring’s "2019 Yearbook and Annual Benefit Report," they are “using business as a force for good.”

The company also hosts myriad events in and out of the plant over the course of a year (well, a normal year), such as daily plant tours, barbecues, bowling nights, puzzle days and one 2019 event called "Bring Your Parents to Work Day."

“We had a hundred parents in the building and we did a tour,” Wilkinson said. “It was a really interesting derivative of the ‘Bring Your Kids to Work Day,’ and it was way more fun and interesting with the parents than it ever has been with the kids.”

The company’s team spirit was put to the test in early May when one of the production workers in the Omaha facility tested positive for COVID-19. Firespring immediately shut the facility down over a weekend to thoroughly sanitize it.

“Fortunately, that team member had been already home quarantining for more than a week because he wasn’t feeling well, and all the people that had been in vicinity of him have been tested and have been cleared,” Wilkinson said. “So we feel like we isolated it quickly based on our safety precautions, but it’s still an issue to think about. That’s the reality we’re in today.”

#2 iColor Printing & Mailing Inc.

Founded in 2008 by brothers Adil and Omar Khan, Los Angeles-based iColor Printing and Mailing (https://icolorprinting.net) has its roots in the early 2000s as predominantly a marketing company. Today, the company has five locations across the U.S. and has a presence in India. The company has 120 employees and came in second in our Top Shops survey with 2019 revenues of $24,584,842.

iColor is a full-service print business that does a little bit of everything in house, from sheetfed to heatset web, to digital printing, to grand format.

“There are only a few things that we don’t do,” Adil Khan said, “one of them being perfect binding.”

In 2019, iColor took a deeper dive into digital printing.

“One of the things that we added in 2019 that was so cool was an HP Indigo 12000 digital sheetfed press,” Adil Khan said. “At the end of 2019—and it’s just getting up and running now—we added the HP T240 PageWide digital web press. That’s really helped us scale our business, just getting the excitement going, and we’ve partnered with HP to bring a new level of print to our customers.”

The two traditional markets iColor has served are education and healthcare, but in 2017, they started accruing a substantial retail business for major chains around the country.

“Our customer demands have gone from high volume to short-run, high-quality work,” Adil Khan said. “Some of the posters that we’re doing for our retail customers feature customization by location.”

iColor also expanded its wide-format capabilities with an HP Latex printer, which also helped further grow the retail side of the business, producing billboards and bus shelter ads.

The hardware iColor bought in 2019 was pretty pricey, so the strategy for 2020 is more on the software side.

“We’re looking at more of a technical approach in terms of software solutions than actually adding more equipment,” Adil Khan said. “We’re integrating now with our customers on a digital level. With organizations like school districts, we’re tying in to their SSO, getting authentication tokens, and working with companies like Clever, where we’re able to make a seamless experience for schools. We’re integrating with [customers’] platforms, whatever their CRM platforms are. We’re working with Salesforce Marketing Cloud. There are so many different places that we’ve got our programming team to work that has helped enable us to get more business at a higher profitability.”

iColor is fortunate in that they have been able to work through the current crisis.

“It’s taken some toll on our production, but we’ve been blessed to stay busy during this,” Adil Khan said. “We were quick to act and assemble a team that is cleaning all of our facilities. I’m proud to say that, with the company being as small as we are, we were kind of ahead of it.”

iColor identified early on the need to be able to weather changes—in whatever form they take.

“The printing landscape is just changing,” Adil Khan said. “It’s not as easy as it used to be, that’s for sure. I think what we’ve done successfully is we adapted to the change. That’s the company model that we’re working with. ‘Innovate and elevate’ are two terms within our company that we try to make sure that we follow every day.

“We’re looking to have a great 2020.I know we’ve got a hiccup, but hopefully L.A. opens back up soon and so does the rest of the world. We’re going to continue marching.”

#3 HBP, Inc.

Founded in 1903, HBP (hbp.com) is one of the oldest companies in this year’s Top 100. HBP has two locations—Hagerstown, Md., and Falls Church, Va.—and 137 employees. Revenues for 2019 were $23,077,000.

As for the keys to HBP’s success, “I would say it’s a combination of investments and focusing on our core markets,” said John Snyder, president.

HBP’s core markets are associations, education and educational publishers. In terms of investments, HBP has heavily invested in UV technology.

“We put in an eight-color UV press and converted a whole pressroom to UV, which really opened up some possibilities with uncoated sheets using four-color process,” Snyder said.

The company also invested heavily in its mailing business.

“Right now, our mailing department is one of our top areas that is staying busy."

A downside is that a lot of HBP’s association work involves trade shows and other events, which have come to a standstill, and in terms of education, schools have moved online.

“So we’ve definitely gotten hit,” Snyder said. “Profits are good, and we got our PPP money, so we’re just going to have to ride the storm out.”

Before things went south in March, HBP had been looking at expanding its digital capabilities.

“The biggest thing that we’re looking at is our digital department,” Snyder said. “We’re looking at inkjet and some different possibilities there. I don’t know exactly what we’re going to do, but certainly we’re going to wait until some of this gets sorted out.”

#4 Professional Printers Inc. (PPI)

With two locations, in Columbia and West Columbia, S.C., and 120 employees, Professional Printers Inc. (www.proprinters.com) comes in at number four in this year’s Top Shops, with 2019 revenues of $21,444,000. In 2019, the company focused on two essential strategies: expanding its already mature sales force and upgrading the company’s digital print capacity.

“We’re very sales-focused as a company,” said Jimmy Kohn, CEO, chairman emeritus and U.S. Army veteran. “Our prospecting, recruitment and retention of the sales team has been critical to our success. Some companies would silo themselves and go after, say, healthcare or other verticals, whereas with our company, it's more of a smorgasbord. We’re a big job shop. We still have situations where people can come in off the street and get something printed, and we’ll work with our major accounts and produce a 260,000 run of a visitor’s guide.”

“Product that needs to be saddle-stitched is probably our sweet spot, as is our die-cutting," President Jess MacCallum said. "We have two die-cutters, so a lot of our growth has been in die-cutting products, oversized brochures, pocket folders and things like that.”

Complementing PPI’s 40-inch Heidelberg presses (in two-color, four-color, six-color and eight-color configurations) and six-color Heidelberg Web-8, the company invested in digital printing with an HP 7900, allowing the company to expand into short-run and variable-data printing.

It’s the customer base, from small local businesses to Fortune 500 companies, that MacCallum feels is the key to PPI’s success.

“Our biggest strength is our diversification and client base,” he said. “We look to new business development every year, and securing new accounts has been one of our strengths as a company.”

PPI’s focus for 2020 has been to discover customers’ evolving needs and find creative and efficient ways to meet them—and that includes helping cope with the current crisis.

“We have two plants running 24/7, nobody has been laid off, and everybody’s still working,” MacCallum said.

Although regular print volume has dropped, PPI has been busy helping out the community and customers. With less than one week’s notice, the company was able to retool to create medical face shields for a local company, producing and delivering much needed PPE to front-line workers.

“Over 200,000 units were shipped in a four-week period,” MacCallum said.

In addition, PPI handed out 1,000 personal hand-sanitizers to customers along with their proofs; printed and distributed 2,000 activity books to the community free of charge, and published a single-use cough shield template online that could be printed on 8.5 x 11-inch paper and made at home.

At the end of the day, it’s all about the customer.

“We’re thankful for our customers,” Kohn said. “That’s something we’ve always focused on. It needs to be win–win—the company needs to win, but our customers need to win.”

#5 Allen Printing Company

Two companies in this year’s Top Six were in the Top Six last year—Firespring (see #1) and Allen Printing Company (www.allenprinting.com), which, as it happened, was also at number five last year.

Founded in Nashville in 1931 by the eponymous Mr. Allen, Allen Printing has been a family-run business since its inception. Mr. Allen had transferred the business to longtime employee Howard “Bunkus” Crump, and then was passed along to Crump’s step-grandson Tony Pack. The company was then transferred to Pack’s daughter, Shannon and her husband Paul Heffington, both of whom run Allen Printing today. The company has one location in Nashville, 123 employees, and its 2019 revenue—$17,000,000—represents a 13% increase over 2018.

A lot of that growth was driven by Allen’s push into new markets, such as the restaurant industry, “which has taken a beating right now, but in 2019 actually had been doing pretty well,” Paul Heffington said. “As we’ve delved into some of those different industries and once we got our footing, we were able to pick up four, five, six, seven others in that area. We did that with banking. We got our foot in the door at one or two places and were able to go, ‘OK, this is what the industry is looking at or needing,’ and then we came up with a customer service plan that would make it easy for them to deal with us.”

Allen Printing is all about customer service—their web header reads “Workin’ Hard and Bein’ Nice since 1931”—and Heffington has attributed a lot of the growth over the past few years to the company’s customer service.

“People want customer service, and that’s been something that has dropped over the last couple of years, not just in printing but basically across the board in every industry,” Paul Heffington said. “Our staff have done a phenomenal job in just giving good, solid customer service, and it shows.”

Like everyone, Allen Printing is looking forward to getting back to normal—and is being proactive about it.

“The biggest opportunity is for us to actually be able to figure out what normal is going to be,” Paul Heffington said. “So for us, it’s trying to quickly jump back in with our customer base and say, ‘OK, what can we help you open back up with? Can we help you with a direct mail campaign? Banners? Signage? Can we help you with throw-away menus?'”

Allen is also paying attention to what the eventual guidelines for business reopening will be.

“We’re trying to beat them to the punch and go to our customers and say, ‘Here’s what we can offer.’ We're trying to be part of the solution, not just reactionary. We’re doing our research into antimicrobial synthetics for menus and different things like that.”

Being able to jump on new opportunities as they present themselves has been a key ingredient in Allen Printing’s success.

“We’ve tried to be nimble and able to adjust as opportunities present themselves," he said.

“That’s kind of where we’ll be with all the shakedown. There are going to be, unfortunately, some companies that will shut their doors and some opportunities that will fall into our lap, so we want to be prepared for that, and figure out how we can expand on those and go deeper into whatever industries opened themselves up to us.”

#6 Cedar Graphics, Inc.

Founded in 1986, with two locations near Cedar Rapids, Iowa, Cedar Graphics (www.cedargraphicsinc.com) rounds out our Top Six Top Shops, with 2019 revenues of $15,000,000.

“One of the big things that we did, and have been doing, is to keep increasing our storefronts,” said Humza Igram, president. “We’ve signed up a few additional storefronts this past year and that really helped a lot. Some of them are former inplant print shops that converted over, others are just looking at implementing more efficiencies. Additionally, we got a couple of new customers that were doing personalized digital printing and other work that came with that, like gift cards and other items. And wide format just continues to grow for us.”

Where once the company’s clientele was heavily concentrated in higher education, for which Cedar Graphics produced brochures and mailings, the company has seen its customer base diversify. While higher education is still their bread and butter, said Igram, “a big Internet company is doing a lot of their business internet mailings through us. A testing company is doing a lot of work with us. Retail stores do a lot of mailings and catalogs. So our customer base is spread out pretty widely, and we continue to reach out and grow those different areas.”

Cedar Graphics also does a lot of work for specialty printers that outsource their commercial jobs.

“There’s a packaging printer, and we do their commercial work, and there are university print shops that just do certain kinds of work. We do the offset work for them," Igram said. "We’re not a trade printer, but we do a lot for other printers, either because they don’t have the capability to do it or they’re higher-end items for them.”

The COVID effect was a little time-delayed for Cedar Graphics, but they were prepared for it.

“Another big market for us is nonprofits, specifically Islamic nonprofits,” Igram said. “And with Ramadan being right now [April 23–May 23], there are a lot of mailers that went out in March, so we stayed very busy in March—busier this March than we were last March—and the first week in April. But we knew that we were going to get hit with it.”

Even after the crisis hit, the company kept busy, and produced face shields early on.

Cedar Graphics is also taking advantage of “productive downtime.”

“We’re keeping people busy with all those projects that we didn’t have time to work on, whether it’s equipment maintenance, certifications, marketing, white papers, just general continuous projects,” Igram said.

They are also boosting their workflow automation and preparing to become a beta site for a new digital press in June.

Cedar Graphics is always upgrading its equipment—“probably more than we should,” Igram admitted — although major investments are on hold for the time being.

“But other than business being down,” he added, “we’re trying not to change too much from the way we normally operate.”

Thanks to everyone who participated in our survey, and congratulations to this year’s Top Shops!