Printing By Numbers

June 2019 printing shipments were up, but down—but up....Industry employment is down all over, and even PR isn’t as robust as it was only a few months earlier....Attrition of print businesses appears to have slowed.

Printing Shipments: The Dog Days of Summer Begin

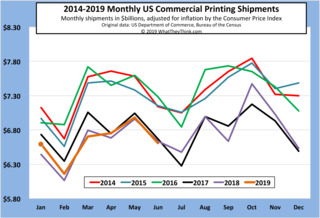

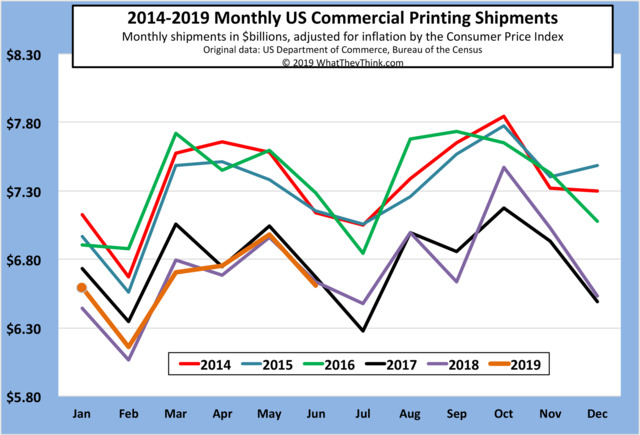

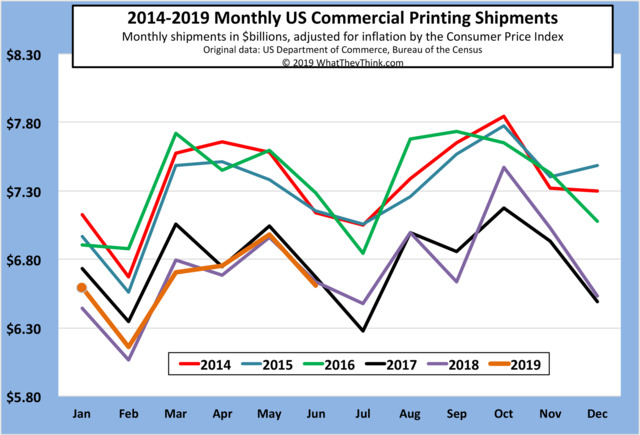

The value of printing shipments for June 2019 was $6.61 billion, down from May’s $6.98 billion, in keeping with what has been established as the new seasonality. It’s a little disappointing that June’s $6.61 billion came in a hair under June 2018’s $6.63 billion—and here we define a “hair” as about $20 million. July tends to be the nadir of the year—and we can hope that it won’t be as nadirish as 2017.

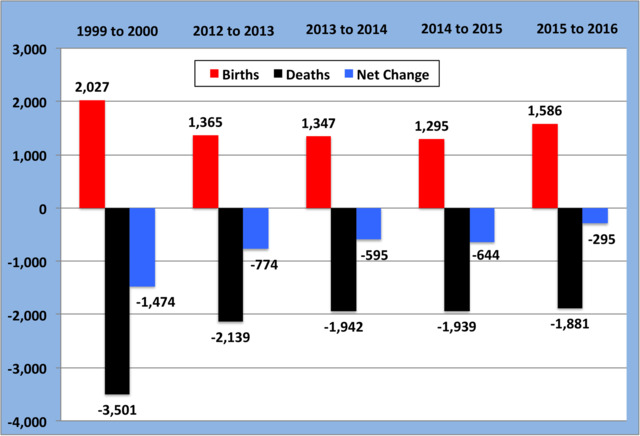

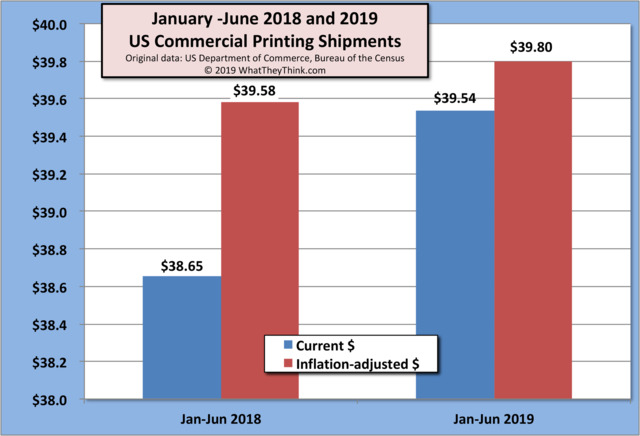

Thanks to a really strong start to 2019, year-to-date shipments continue to outpace 2018—January to June shipments for 2019 are at $39.80 billion compared to 2018’s $39.58, although the gap is closing.

As we continue into the dog days of summer, maybe July will be a pleasant surprise and August will continue its seasonality.

Still, we do have to caution—as we always do—that NAICS 323 (which is what these shipments' data are based on) isn’t necessarily the sole printing-related three-digit NAICS anymore. Some shops are classifying themselves in different kinds of services NAICS, and wide-format and sign manufacturers have their own NAICS classifications. Different parts of the industry are diverging from NAICS 323, which makes tracking industry statistics that much more of a challenge, and can make the industry seem much gloomier than it really is.

Jobs: Up in the Short Term, Down in the Long Term

June employment numbers from the Bureau of Labor Statistics show that overall printing employment grew +0.5% from May to June 2019. However, on a year-over-year basis, it’s down -2.5%. Production employment grew +0.4% from May to June, but year-over-year was down -4.9%. Non-production employment was up +0.7% from May to June, and up +2.6% from June 2018.

In publishing, employment grew from 732,700 in May to 738,300 in June, and grew +0.7% year-over-year. Newspapers continued to take a hit employment-wise: down -8.2% from May 2018 to May 2019. Periodicals are not far behind, with a -4.2% decline in employment from May to May.

The creative markets, once again, are doing better than printing and publishing, although the traditional hotspot, public relations, was only up +2.5% from May 2018 to May 2019. (Back in May, PR employment was up +6.7% from March 2018 to March 2019.) Among agencies, employment was down -0.3%, but if we back out PR, agency employment was down -0.6%. Graphic design employment was up a little, and direct mail advertising was down a little more of a bit.

Overall, the employment situation in the economy has been very good; the June jobs report had been better than expected, with 224,000 jobs created in June and an unemployment rate of 3.7%. Still, if we look at the employment rate for prime age workers (25 to 54), in June it was 79.7%—down from the 2000 peak of 81.9%, the pre-recession peak of 80.3%, and even the 79.9% peak earlier this year. So while the headline unemployment number looks pretty good, there is still a bit of room for employment growth.

The industry has a tough enough time attracting workers even when the labor market isn’t tight, so finding workers is not going to get any easier.

Interestingly, over the summer, Chase announced (https://bit.ly/2YvNU8a) that it was replacing the copywriters for its marketing materials with artificial intelligence —not because it has a shortage of copywriters, but because customers were more responsive to machine-written content. Automation may be a solution to the problem of finding elusive employees, but it is also being implemented (in our industry and elsewhere) primarily to reduce costs and improve quality. While the “robots are taking my job!” fear is a little overblown (for now...), it’s entirely possible at some point that there may be a surfeit of potential employees coming on the market.

It’s Alright, Ma

He not busy being born is busy dying

—Bob Dylan

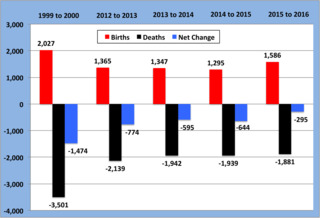

We can look at industry birth and death data to get a sense of how the industry is stabilizing and even improving—to some degree. From 2015 to 2016 (the most recent period for which we have data, which just came out over the summer), there has been an increase of nearly 1,600 establishments, but a decrease of just under 1,900 establishments, for a net loss of about 300 establishments. In that 2015 to 2016 period, we saw a much greater number of births and a smaller number of deaths compared to previous periods. So it goes.

Essentially, we’re still looking at a net attrition of printing businesses, a combination of consolidation and straight-out plant closures, but this attrition seems to have slowed, although we’ll have to wait for the 2016 to 2017 data before we can identify any specific trend. But given what we have been seeing with shipments in the years since 2016, we should expect this situation to have improved even more.

At the same time, births and deaths don’t always represent brand-new businesses or pushing-up-the-daisies dead ones. Rather, businesses often change their corporate structure. A corporation closes, a proprietorship opens. So it is often the same people just changing their tax structure. Also, this is often a “poor man's consolidation”: Two struggling print businesses find it cheaper to close and then open as a single new business, without dealing with the legalities and details of a merger or an acquisition.

And, as we explained above, it’s also possible that certain businesses have changed their business enough that they end up in a different NAICS (the data presented here only tracks NAICS 323).

So there can be a lot of stuff happening beneath the surface of these birth and death data.